Dread the month’s end? Our three-stage strategy dispels the gloom

3 Steps to Close the Books in 5 Days or Less

For finance teams, speeding the monthly close and reporting process has been a priority for years — a priority that most never quite get to. Despite its acknowledged importance, many companies still struggle to close the books in less than two weeks.

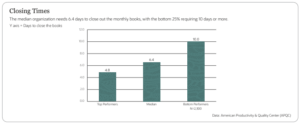

In fact, a survey conducted by the American Productivity & Quality Center shows that the average organization needs more than six days to close out a month’s books.

The APQC asked 2,300 companies about their cycle time to monthly close metrics and found that it’s not that uncommon to take two full workweeks.

CFOs need to do better. Shortening the financial close is no longer a “nice-to-have.” Rather, it is a competitive necessity. Businesses need accurate numbers delivered on time, preferably without so much legwork from the finance team.

The good news is that many of the steps required to shorten the close time will help with other goals, like supporting digital sales channels and improving vendor relations. In this guide, we’ll outline the three ways companies can shorten the financial close to five days or less — and in the process transform the finance team into the strategic resource that your business deserves.

STEP 1

Embrace Automation

The most impactful step in shortening the close is eliminating manual processes through automation. Nearly 70% of respondents in a survey by The Hackett Group reported that manual processes were the biggest bottlenecks in their close and other accounting operations. Every month, without fail, team members scramble to pull together information they need from around the company.

But that doesn’t mean finance is at the mercy of a dated, manual checklist. The majority of steps in the close are prime candidates for automation:

- Identifying transactions: The goal of accounting automation is to identify all needed data for the close already stored and verified in a centralized system — more on that shortly. Sources like vendor billing details, employee expense reports, bank statements and other documents will be analyzed to determine if the transaction actually exists and whether or not it is relevant to the business. For the most part, this should happen without human intervention.

- Entering transactions into a journal: This process should be automated so financial activity is recorded as it happens.

- Posting transactions to the GL: When transactions sync to the GL immediately through automation, finance teams are closer to being able to perform soft closes on demand at any time. Amortization and depreciation schedules, P&L allocations and other routine calculations can automatically operate against stored data, and that will reduce work at the end of the month.

- Reconciling bank accounts: A study from Ventana Research shows that 72% of those that automate most or all of their reconciliations finish in under six days compared with 25% where just some or none of that work is automated. Especially for companies with several bank accounts, reconciliations can become more efficient through rules-based automation that automatically matches statements to records and flags any anomalies.

- Creating adjusting journal entries: In addition to correcting errors, accounting may also need to create adjusting entries to record deferrals, accruals and non-cash expenses like depreciation. Automation can create schedules for deferred revenues, fixed assets, loans and other recurring items to eliminate the need to calculate these manually.

- Preparing financial statements: Accounting automation will then curate and generate financial statements. Often, these automation tools will have the capability to deliver custom reports to meet the requirements of different stakeholders.

In addition to the basic steps in the close, automation can help with some of the more complex components of the financial close, including:

- Intercompany eliminations: As a part of the close process, an automation system will evaluate activity in intercompany accounts and create the journal entries to eliminate artificial profit and loss.

- Financial consolidation: For companies with subsidiaries, an automation solution will post and consolidate subsidiary-level accounts, saving time and improving compliance with accounting standards and reporting requirements.

- Revenue recognition: Revenue recognition standards, like ASC 606 and IRFS 15 for US-based and global organizations, respectively, are complex and unique to each organization. Software, however, can manage these requirements. Various studies conclude that just automating revenue recognition for ASC 606 can shorten the close up to 80%.

- Currency translation: Transactions entered by business units using a foreign currency can be automatically converted and posted to the general ledger, using the appropriate currency and current exchange rate.

- Variance analysis: Immediate automated variance analysis allows a business to take action even while the reconciliation and close activities are still in progress, rather than waiting on the sidelines for period end numbers to roll out.

Where to Begin Automating

Unsure where to start in the automation journey? Break down the close and identify which foundational areas — like accounts receivable, accounts payable and the general ledger — are resulting in the most errors or taking up the most time. Tackle automating the tasks that build into that area first to get the most bang for your buck.

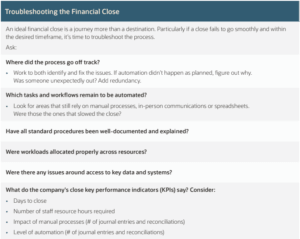

Standardize and Document Virtual Workflows

For most companies, the closing methodology has been developed over time, resulting in a mix of discordant processes. Leveraging technology to improve a flawed process is a common mistake organizations make. Before applying technology to speed up the close, it’s worthwhile to review the process already in place.

The intent of this review is to create standardized workflows that can be conducted remotely to reduce risk, time spent and complexity. A silver lining of the pandemic is that it gave finance chiefs the opportunity to improve their remote close processes; don’t give up that progress now that the finance team is back in the office. That learning is key to shortening close cycles.

Using standardized workflows to guide process execution helps because it ensures that all necessary steps are performed, all phases are executed consistently across an organization and the hand-offs between those doing the work are coordinated. A study by Ventana Research found that only 14% of heavy users of standardized workflows find waiting for others to complete their work an issue compared with 40% without standardized workflows.

Creating standardized virtual workflows involves first creating a virtual “close command center” staffed with the people who organize and oversee the activities involved in executing a remote close. They will also work with the IT help desk to address any technical issues that might arise and ensure compliance standards are met.

They will then:

- Determine processes in the financial close that need to be standardized.

- Identify process configurations currently in use and brainstorm opportunities to unify different process configurations.

- Map out the close process step-by-step — visual tools, like flowcharts, are helpful.

- Invite finance and accounting team members to review the process map and make edits where needed. Bring in IT and other stakeholders where applicable. More input at this stage is better than too little.

- Document the decided workflow in a virtual close playbook. Describe each step in the process, delineate a detailed schedule and state who is responsible for completing the work. This will serve as a day-to-day guide for the command center, help analyze and resolve accounting resource conflicts and identify any significant capacity constraints.

- Upload the playbook to a platform where everyone can access it at any time or place — ideally in the cloud. If key team members are out, or if new employees need training, the process description can keep things moving. You might also develop a more concise checklist at this point.

Not only does workflow standardization provide a clear framework for the close, but the activity itself can reveal challenges and opportunities for improvement in each process. It may also identify processes that are outdated or no longer needed for the close.

Once standardized and well-documented, companies with the appropriate technology can then automate workflows. Workflow automation provides the checklists, roles, rules and processes for review, reconciliation and approval or rejection. These are defined once and then repeated.

STEP 2

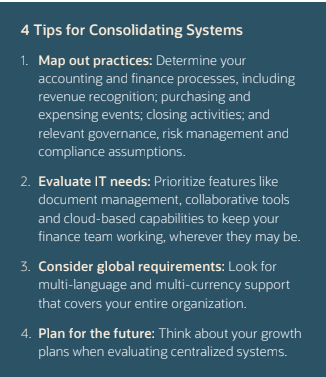

Update and Consolidate Systems

A study by Ventana Research showed that companies that rely heavily on spreadsheets are more likely to have longer monthly closes: Just 16% of companies that make substantial use of spreadsheets in the close process complete it within four business days compared with 33% that limit them to occasional use. Conversely, 33% of organizations that limit spreadsheet use in their closes take seven or more days versus 54% of companies that use them extensively.

In short: You won’t achieve a fast, accurate close with spreadsheets.

As finance teams think about phasing out spreadsheets for more up-to-date technology, it’s tempting to adopt point products that excel in each area. But unless all these systems can communicate, automating the close is next to impossible. Finance teams then run into trouble during the close as they manually compile, confirm, consolidate and transfer financial data from various systems, regions, subsidiaries, spreadsheets and even different ERP and general ledger systems. The result is a slow, error-prone close.

Conversely, a single, centralized database means a single source of real-time transactional, financial and operational data. That reduces the risk of error by eliminating duplicate data entry. Automation is easier when each automated process gets its data from the same repository.

Additionally, a single system will provide better document and information management. Collecting documents is often one of the most time-consuming tasks faced by finance teams. Spending time finding receipts or looking for approvals isn’t just tedious and inefficient; it can lead to poor audit trails and will lengthen any closing process.

A unified business management platform integrates accounting, inventory management, sales, shipping and other departments’ needs, providing a single repository of data that eliminates the hurdles, frustrations and delays caused by storing information in department silos.

STEP 3

Incorporate Continuous Accounting

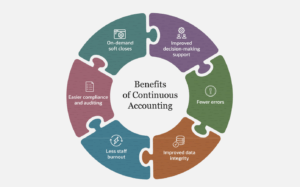

After implementing the steps above, your finance team is well on its way to achieving a valuable practice called “continuous accounting.” Also referred to as a “continuous close,” this practice involves gradually closing the books on a day-to-day basis, such that you’re working toward the close throughout the month.

When fully transitioned to continuous accounting, a company will be able to perform a “soft close” at any time because the accounting team is constantly processing and aggregating relevant financial information. Reconciling just three or four items per day instead of 70 items at month-end can make accountants’ jobs significantly easier and expedite the process.

Continuous accounting does not simply entail spreading out close tasks, though. All that would do is front-load the work. Continuous accounting involves adopting the aforementioned practices around automation and integrated technology so tasks like journal entries and reconciliations are conducted automatically throughout the month with minimal effort from the finance team.

When the end of the month rolls around, the team will just need to finalize the financial statements for investors, the board of directors and, in the case of a public company, shareholders — much more doable when you don’t need to spend days or even weeks sorting through a huge influx of information.

How NetSuite Enables a Faster Close

NetSuite delivers a complete financial management solution with the capabilities needed to significantly shorten the month-end process — including supporting a continuous close.

Benefits NetSuite provides to shorten the financial close cycle include:

- Automation of integral day-to-day business processes like accounts receivable and accounts payable.

- Automation of a wide range of repetitive tasks, including journal entries, transaction matching, bank reconciliation, intercompany transactions elimination, revenue recognition and more.

- Transaction matching.

- Embedded controls, support for US and international accounting standards and financial consolidation capabilities to help maintain compliance with complex rules and regulations.

- Automatically distributed financial statements to internal and external stakeholders, with custom reporting formats to meet the needs of different audiences.

- A cloud architecture so accounting staff have secure access to needed information anywhere, anytime, as well as visibility across departments.

Especially in today’s business environment where efficiency is key, organizations need their finance teams focused on high-value tasks — not time-consuming, manual close processes.

Companies that continue using prolonged traditional accounting practices will miss valuable opportunities. Ready to take your financial close to the next level?

Click here for a free NetSuite product tour.

Learn More

- 17 Steps to Improve Operational Efficiency. Operational efficiency is all about how businesses reduce waste, increase productivity, and improve the quality of their products and services.

- Spectrum Color Sees New Shades of Efficiency After Centralizing Business in NetSuite. A single source of data helped this manufacturer increase revenue, automate order management and save its staff valuable time.

- NetSuite 2022 Release 2 Helps Protect Your Bottom Line By Increasing Efficiency. When faced with uncertainty, a leader’s priority is to run the businesses efficiently, focusing on robust bottom lines as much as revenue growth.

- The Future of Finance. 90% of CFOs will use automation, AI, and fintech by 2024.