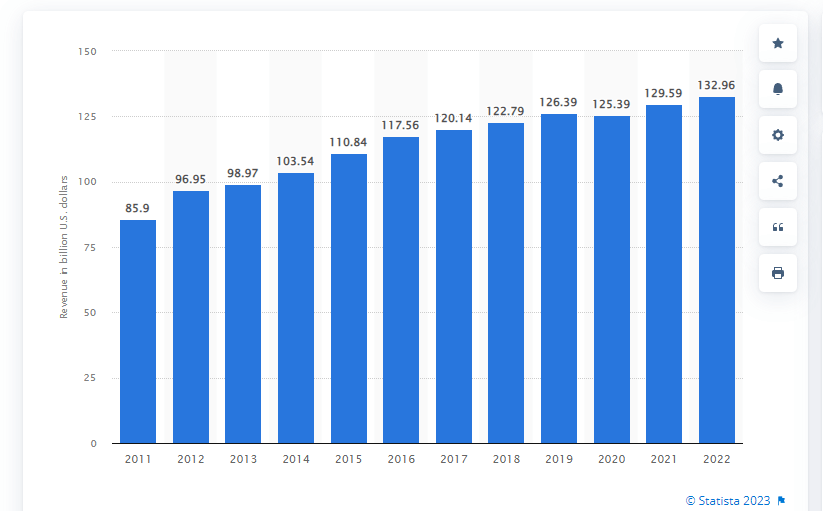

In a world historically grounded in the trusted expertise of accountants, an alarming trend emerges: a growing exodus from the traditional pillars of finance. Over the last two years, the U.S. has seen a 17% reduction in accountants and auditors, with over 300,000 professionals departing from their roles. A shift not only influenced by retiring professionals but notably, younger accountants who seek promising horizons in finance and technology.

As the profession grapples with educational demands, perception challenges, and evolving priorities of the youth, the business landscape responds with an increasingly enticing solution: outsourced accounting. Offering cost-efficiency, global expertise, flexibility, and advanced tech adoption. Outsourcing seems poised to reshape the future of the accounting sector and how enterprises approach their financial operations in the years to come.

The Generational Shift and the Lure Beyond: It’s not just about the retiring baby boomers. A surprising number of younger professionals, between 25-34, and even midcareer accountants aged 45-54, have been hanging up their green eyeshades. But where are they going? Interestingly, the greener pastures seem to lie in finance and technology

- Finance: The world of finance has grown exponentially more diverse than the straightforward accounting roles of yesteryear. Investment banking, fintech startups, asset management, and financial consulting are just a few of the dynamic avenues beckoning these professionals. These roles promise not only competitive salaries but also opportunities for rapid advancement and engagement with high-profile projects and clients.

- Technology: The tech industry, on the other hand, is not just about coding or software development. There’s a vast realm where technology intersects with finance, known commonly as ‘fintech’. Here, accountants find roles that leverage their numerical prowess and analytical skills in areas like blockchain, AI-driven financial solutions, and digital banking innovations. Moreover, the tech sector’s startup culture, characterized by its agility, innovation, and groundbreaking solutions, offers a stark contrast to the perceived rigidity and predictability of traditional accounting roles.

The Educational Roadblock and the CPA Conundrum: Accounting, once deemed a gateway to a respectable and lucrative profession, now demands more academic rigor than before. For the coveted CPA license, one needs 150 credit hours—that’s 30 more than the standard bachelor’s degree.

This not only means an extra year in college, but it also saddles aspiring accountants with additional financial burdens. For many aspiring accountants, this means grappling with additional student loans, extended periods without full-time employment, and the deferred dream of launching their careers. This extended period of study not only impacts the immediate pocketbook but also has longer-term repercussions, potentially delaying other life milestones like home ownership, starting a family, or investing for the future.

Additionally, the count of CPA exam candidates has consistently declined over the last decade. From nearly 50,000 candidates in 2010, the figure decreased to just above 32,000 by 2021.

Certainly, initiatives such as the collaboration between PricewaterhouseCoopers and Saint Peter’s University, which provides work-for-credit programs, are commendable attempts to ameliorate the barriers to entry in the accounting field. However, the underlying deterrents remain deeply entrenched.

PwC, recognizing the changing educational landscape, is pioneering efforts to bridge the gap. Their collaborative programs with renowned educational institutions are just one facet of their strategy to promote ease of access to requisite qualifications. Moreover, this increased accessibility to education has rendered acquiring advanced degrees and certifications more convenient than ever.

Yet, the perplexing question lingers: with education more accessible and flexible than before, why is there still a noticeable decline in individuals pursuing or sticking with accounting roles? Could it be that the very nature of the profession, irrespective of the educational accessibility, is what’s driving the shift? The answer may lie in deeper societal trends, changing perceptions of the profession, and a pandemic of distaste for the pursuit of corporate structure.

The Perception Quandary: Is Accounting Still Cool?: Ask a college student about accounting and their face might betray a flicker of uncertainty, if not outright dread. For many, the profession evokes images of daunting hours and drudgery. And while it’s undeniable that the field promises stability, the modern youth is increasingly seeking dynamic, immediate opportunities. Consulting firms, tech giants, and banks are now the shining beacons for fresh graduates, offering salaries and roles that often outshine what traditional accounting paths can present.

- The Legacy Perception: Historically, accounting was viewed as the bedrock of commerce—a meticulous and essential role, requiring an analytical mind and an unwavering attention to detail. Its practitioners were perceived as the gatekeepers of financial integrity. While these foundational principles remain true, the external perception, especially among the younger generation, appears to be shifting.

- The Modern Image Challenge: For many, the very term ‘accounting’ conjures up images of endless spreadsheets, daunting hours spent in cubicles, and a seemingly monotonous drudgery. Yes, it’s undeniable that the field promises stability—a trait that in the past would be enough to attract a plethora of talent. However, the priorities of modern youth are evolving. They seek roles that are not just stable, but also dynamic, versatile, and offer immediate opportunities for impact and growth. They’re hungry for roles that promise them not just a paycheck, but a platform for innovation and creativity.

Jordan Pixley, a fresh graduate from Clemson University, encapsulates this sentiment. Despite his accounting major, he’s wary of the rigorous hours and finds more joy in data analysis—a more vibrant and immediate application of his numerical skills. For him, and many like him, the question arises: Why traverse the challenging route of accounting when the world teems with swifter, arguably more exciting, avenuesI?

In the corporate landscape, firms like KPMG are waking up to this existential challenge. From revisiting pay structures—like offering successive pay raises—to bolstering outreach efforts in colleges, the battle for talent is intensifying. But the onus isn’t solely on the corporations. The academia and the broader industry too must rebrand and underscore the myriad possibilities an accounting degree can unlock.

The prevailing winds signal a transformative era for accounting. Whether it’s a temporary phase or an irreversible trend, only time will tell. But one thing’s certain: The world of numbers is experiencing a reshuffle, the effects of which will reverberate through the annals of finance.

At this pivotal juncture, the immense potential of outsourced accounting begins to reveal itself, shining brightly as a beacon of hope and opportunity for a multitude of enterprises. In a business landscape fraught with challenges and uncertainties, especially surrounding the availability and retention of skilled accountants, the prospect of harnessing external financial expertise offers a promising alternative. Not only does it provide a potential solution to the existing accountant shortage, but it also opens up a plethora of benefits,

- Cost-Effective Outsourced Accounting: The age-old adage, “cut your coat according to your cloth,” finds deep resonance in this context. Resorting to an outsourced accounting service typically culminates in palpable monetary benefits. Circumventing fixed expenses, including staff salaries, perks, and extensive infrastructural costs, firms discover they’re not just maintaining, but often enhancing their financial health. This enhancement is coupled with the premium service quality that comes from accessing a reservoir of experienced professionals’ collective wisdom.

- Global Financial Expertise On-Demand: The inherent charm of outsourced accounting rests in its immediacy and availability. Visualize a battalion of financial maestros, each bringing a distinct expertise, on standby to navigate your enterprise through intricate financial terrains. This level playing field of expertise ascertains that your firm’s financial undertakings are managed not merely competently, but exemplarily.

- Flexible Growth with Outsourcing: The natural highs and lows accompanying business growth can overburden traditional in-house teams. In contrast, outsourced accounting frameworks are innately tailored to synchronize seamlessly with your evolving business needs. Be it launching a fresh outlet or moderating operations, these external services mold themselves with enviable agility, eliminating the chaotic cycles of recruitment and onboarding.

- Focus on Business Core Strengths: Rooted in the timeless principle of specialization, as a musical virtuoso hones in on perfecting their melodies, enterprises ought to zero in on their primary strengths. Delegating the financial domain to external experts underlines this philosophy, permitting firms to channel their energy, passion, and resources into their unique niche. The result? Fewer fiscal diversions and a laser-focused progression towards strategic milestones.

- Advanced Financial Tech Adoption: The financial realm is continually rejuvenated by technological breakthroughs. With a mission to stay unmatched in their offerings, outsourced entities ensure they’re spearheading these tech frontiers. Partnering companies, consequently, enjoy the privilege of employing these cutting-edge tools without the intricate hassles of acquisition and upkeep.

In the broad spectrum of contemporary business tactics, the accountant deficit, though undeniably a hurdle, can be adeptly transformed into an advantageous pivot. By gravitating towards outsourced accounting, companies are not merely identifying a makeshift solution. As businesses weigh the merits of outsourced accounting, there arises a pertinent question: “Who can we trust to guide us through this transformative journey?”

Our company prides itself in a team with decades-long expertise that ensures that businesses aren’t just navigating the financial terrains but mastering them. With a team of Certified CPAs and NetSuite Experts, we address complex procedures from AR/AP to audits, ensuring precision and efficiency at every turn. Our team’s diverse background brings a mosaic of best practices from various industries.

Why does Salora ERP stand apart? We’re more than just a service.

We offer an all-in-one solution – managing audit preparation, streamlining AR/AP processes, ensuring financial records are audit-ready, providing insightful budget analyses, and more. Our monthly closing services and tailored financial planning strategies ensure businesses are always ahead of the curve.

By embracing outsourced accounting and partnering with seasoned experts like Salora ERP, companies aren’t merely sidestepping challenges; they’re charting a visionary course that synergizes cost-effectiveness with unparalleled expertise, assuring growth and stability in an ever-evolving commercial environment. They are wholeheartedly adopting a strategy that synergizes cost-effectiveness with peerless expertise. This isn’t just a momentary detour; it’s a visionary blueprint assuring both steadfastness and expansion amidst an ever-shifting commercial milieu.

Contact Us and let’s make NetSuite easier today!