The talent shortage isn’t abating.

One coping strategy: Increase your team’s output.

If you’re a CFO or senior leader in finance, you’re likely spending a lot of time these days figuring out how to make the most of the human and technology resources you have available. You’re not alone. Purse strings have tightened, and CEOs and owners in many industries have asked leaders for strategies to boost profitability without spending more.

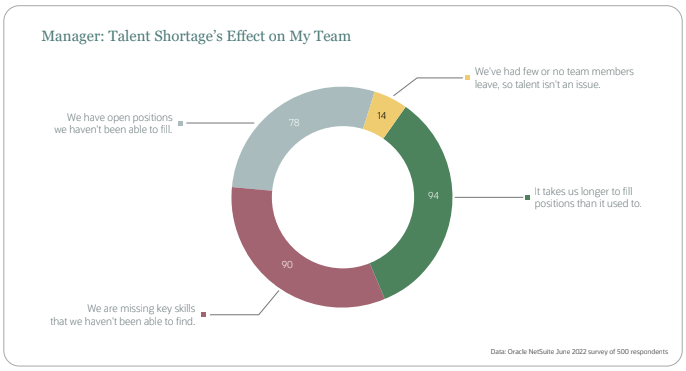

Challenges around labor are a top concern. Companies of all sizes worry about availability of and competition for talent. But they also face challenges around current team member satisfaction and retention. The cost of recruiting, onboarding and training new team members is rising — and companies are spending more for people with less experience and expertise. Expectations for a stronger work-life balance, especially among younger workers, has sparked conversation around “quiet quitting.”

All these challenges are coming at CFOs in a time of layoffs, hiring freezes and a wait-and-see mandate with no clear end date. Everyone is eagerly reading the latest monthly CPI number, jobs report and financial market tea leaves for leading indicators of what’s to come, but they’re getting mixed signals.

It’s a perfect storm that has left senior finance leaders with a mandate to get more out of what they have. We’re here to provide tips on how to do that.

CHAPTER 1

All Arrows Point to Efficiency

Generating higher productivity by saving employee time and effort is all about finding inefficiencies, developing better processes and using data to prove efficacy. Then rinse and repeat.

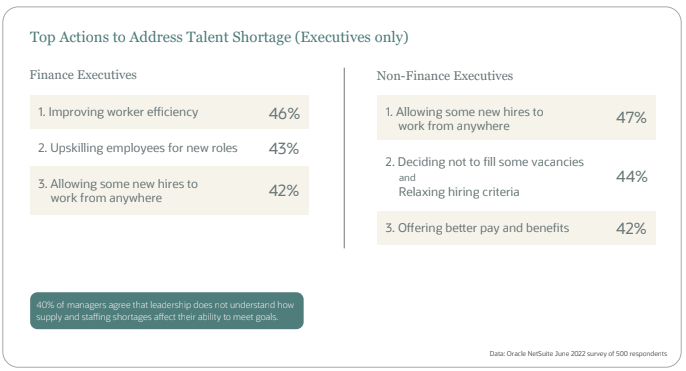

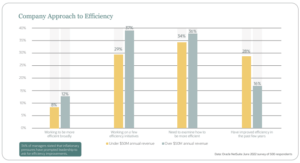

What’s driving this renewed focus on doing more with less? The latest NetSuite survey suggests a few causes:

- 40% of managers say leadership doesn’t understand how staffing shortages affect their ability to meet goals.

- 80% of managers say their teams struggle to meet obligations because of talent shortages (21%), material shortages (19%) and poor tools and processes (23%).

- Asked how to best resolve these issues, the No. 1 response at larger companies was “improve efficiency.”

Managers are realizing that throwing money at the labor problem is no longer a viable option. As long as demand outpaces supply, the most effective solution is staff optimization.

CHAPTER 2

Why Is This Such a Big Deal Now?

There’s a circular relationship among efficiency, productivity, growth, business health, agility and job security for your people. Fiscal conditions have changed quickly as soaring inflation spurs the Federal Reserve to raise interest rates in an effort to cool down an overheating economy. This has companies looking for ways to make the most of their existing resources rather than deploying scarce and expensive capital to generate results.

Efficiency serves the growing priority of profitability.

Becoming more efficient increases output, which is a driver for the bottom line. An efficiency improvement program is a win-win because you aren’t necessarily calling for additional investments to support these better outcomes.

And if you are asking for additional technology or manpower, you’ve first proven that your finance team is maxing out what’s possible to achieve with current resources.

It protects the business.

Efficiency is also the go-to strategy in uncertain times. Economic environments ebb and flow, and the labor market changes with them. Having the ability to get the most out of what you have protects the business during less predictable periods. And being able to tie your work to strong results even if your team’s resources must be reduced shows you’re a top performer.

It lets you play the long game.

Increased efficiency is also a hedge against demographic changes that alter the available workforce as older employees with difficult-to-replace skills, experience and institutional knowledge edge toward retirement. It gives you more time to seek out and onboard new talent and get them trained in their roles.

It provides business agility.

From a macro perspective, greater productivity means bigger profits for the business and the ability to seize new opportunities that come along, even in challenging times. That’s quite a competitive advantage if you’re up against a company that’s operating inefficiently and struggling just to handle what’s on its plate. You might even wind up acquiring that struggling competitor — and improved finance efficiency makes the M&A process a lot smoother than it otherwise would be.

It makes team members happier.

Lastly, efficiency is actually good for your existing staff. If a business is in trouble due to inefficient operations, leadership starts looking around for fast ways to cut costs. One common answer is layoffs, which may make the problem worse. In that sense, driving efficiency can translate to job security.

And contrary to what some may believe, efficiency doesn’t mean burying your team members in work and sparking burnout. You can get there by improving processes and adding the right technology. These tools allow employees to work intelligently and spend time on tasks that leverage their unique skills — that’s motivating and fulfilling. It’s the difference between being ordered to transport water in leaky buckets vs. installing a plumbing system.

CHAPTER 3

5 Ways CFOs Improve Finance Team Efficiency

1. Process reviews and improvements with an eye to efficiency.

Finance teams normally have many defined processes that bring a degree of order and consistency to their work, which is in theory a good thing. But it can also be a source of issues. A process that introduces inefficiencies and is being faithfully and consistently followed? Worst case. A bad process that employees ignore? Better, but it’s neither ideal nor repeatable, and it won’t win you points at audit time.

A process that’s firing on all cylinders and delivering productive, desired results? That brings great comfort and confidence to both managers and finance talent.

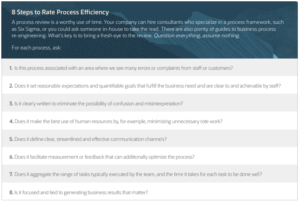

When undertaking process improvements, keep the acronym DMAIC in mind: define, measure, analyze, improve, control.

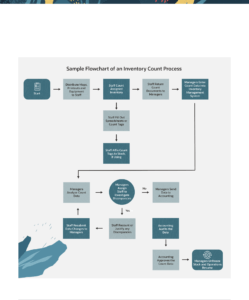

It can be helpful to generate maps, normally in flowchart form, for each major process.

Ask staffers about the pain points they encounter. Then, when making improvements, explain the reasoning, and keep stakeholders engaged. People tend to resist change less when they feel heard.

2. Fine-tuning employee culture with a bias for engagement.

While process mapping is a key component here, productivity relies on the experience, skills and focused dedication of real-life staffers. In an environment where the labor pool is shallower, skilled employees have numerous options, and retention is more important than ever. The work culture you establish can be a make-or-break factor for efficiency.

Employees understand that they are there to do a job, with expectations that must be met and goals that must be achieved. But along the way, they are looking for an environment that fosters the ability to do their best work.

For employees, cultural wins include:

- A low-stress workplace;

- A sense that they are respected and appreciated by managers and executive leadership via, for example, upskilling opportunities;

- Having good work noticed and celebrated;

- A work environment they can personalize to a reasonable extent, such as choosing their preferred devices;

- A place where they are trusted and treated like adults — think flex time, remote work and a liberal vacation policy;

- Competitive compensation;

- Managers who respect the need to balance work and personal demands;

- Support to continue their professional growth and gain new experience; and

- Encouragement to have their own new, innovative ideas heard.

A healthy, positive culture is absolutely key for employees to deliver their best work and do it efficiently.

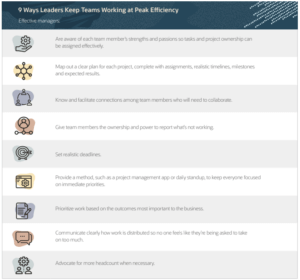

3. Workload management is a focus.

This is a specific area that intersects with both processes and culture. Finance leaders must fully understand the volume and type of work that needs to be accomplished and how that aligns with the size and experience of your team.

On an efficient finance team, everyone is fully engaged but not overwhelmed. They work on projects at which they excel and understand how they contribute to overall business goals and viability. Setting reasonable expectations for team members minimizes the possibility of overwork and errors from rushing or burnout. All are efficiency killers.

4. Foster transparency and cross-collaboration.

“Too many cooks in the kitchen” is really just a nice way to say, “There are too many people involved, and this is going to be hopelessly inefficient.”

But when it comes to finance teams and how they relate to other departments, broad transparency and collaboration are key to avoiding chaos, not to mention missed opportunities, false assumptions and wasted or duplicated effort.

Far from fostering inefficiency, visibility is a superpower both within and between teams.

Widely shared KPIs can reveal the need for immediate adjustments or new approaches. Managers and team members, regardless of department, may spot gaps in efficiency and share suggestions based on their experience. This makes it easier to find opportunities for cross-functional collaboration. And leadership can see at any time what teams are working on and how they are progressing toward goals — making sure all that effort is spent on things that directly advance business priorities. No worker and no team wants to be busy doing work that doesn’t really matter.

5. Add technology where it will make an impact.

It’s no secret that technology is critical to efficiency gains, but you’ll want to work through the steps above to gain clarity on where you can make the biggest positive impact with technology.

This strategy is not about replacing human talent with automation or artificial intelligence, even if your staff initially has those fears. Rather, it’s about leveraging technology to handle what it’s capable of — particularly morale-sapping, basic repetitive tasks — so that human talent can be allocated to jobs that only they can do well.

In this way, the business is getting the full value of those employees, who are more productive and happier now that automatable tasks have been taken off their plates.

Depending on the finance team’s needs, technology can handle things like:

Accounts receivable

- Generate and send invoices, as well as follow-up reminders for payment

- Make accurate tax calculations

- Auto-post transactions to ledgers

- Define credit terms

- Manage and speed up collections with multiple payment options

- Shorten the credit-to-cash cycle

- Check the status of receivables at any time

- Use customizable dashboards for detailed reports and data visualizations

Accounts payable

- Auto-review, route for approval and pay supplier invoices

- Maintain detailed vendor records

- Create and manage purchase requests and improve accuracy by automatically matching invoices to the correct vendor and purchase order

- Stop manually entering debits and credits

- Cut the time required to process bills

- Get immediate access to key AP info

Companies also find success with automation for expense reporting and other business processes, like automated order entry, batch processing, file transfers and report generation and distribution.

If the technology finance uses is part of a larger enterprise resource planning (ERP) suite, data flows effortlessly in and out of the finance team’s functions for a full view of the business and customers that updates in real time.

CHAPTER 4

How to Know if Your Team Is Efficient

You probably know the answer: relevant KPIs. Sadly, too many businesses, and too many teams within those businesses, aren’t tracking activity because they either don’t have the tools to easily do so or they’re not sure what to track.

KPIs are about knowing which metrics that your team impacts actually move the needle toward departmental goals that align with and contribute to the larger priorities for the organization.

You’ll often hear these described as the “metrics that matter.” Not all metrics do, and expending effort to track those that don’t really matter creates inefficiencies and frustration.

To measure finance team efficiency, it’s important to look at data related to individual performance, including:

- Time expended per task, possibly based on timing tasks for a fixed period across workers to understand how long they should take;

- Percentage of work that must be redone or revised;

- Level of assistance needed to complete assigned tasks;

- Volume of output;

- Quality and accuracy of work;

- Number of years employed;

- Absenteeism; and

- Soft skill scores and culture fit estimations.

And collective team performance metrics like:

- Days to month-end close;

- Accuracy and timeliness of financial statements;

- Process refinement opportunities discovered and implemented;

- Collaborations with other departments that contributed to faster closes;

- Number and resolution speed of inquiries to the finance team;

- Employee turnover rate (ETR);

- Employee satisfaction scores;

- Higher scoring on knowledge evaluations post-training; and

- Internal promotions vs. external hires for open roles.

Ultimately, improvements in these efficiency metrics will have a positive effect on those financial metrics mentioned earlier, including outstanding invoices, invoice dispute resolution, performance against budget, cash flow, customer satisfaction and retention, accounts payable turnover, profitability and liquidity.

CHAPTER 5

Setting Smart KPIs

It’s generally safe to assume that the more efficient the finance team, the healthier the business’s bottom line — which is why it’s important to track KPIs with direct ties to performance and use data to improve organizational performance by highlighting opportunities to fine-tune processes.

- KPIs should be easy for employees to understand so they come away with crystal clarity about what they are being asked to do.

Employees must never feel that the purpose of a KPI is to track their performance for the purposes of individual judgment, enforcement or building a negative record against them. They must not be threatening in nature. - KPIs must be transparent, and employees must be able to see how they’re progressing on their goals at any point.

Apply the SMART principle, meaning each KPI should be Specific, Measurable, Attainable, Realistic and Timely. In addition, they should be demonstrably tied to larger goals or the overall health of the business. - KPIs should have a clear owner. In other words, there should be someone tasked with tracking and analyzing results. Without ownership, KPIs can easily become checkbox items that deliver no improvements or usable insights.

- KPIs must be adaptable. Conditions in the global and US economy, your industry and the business are always changing. Those changes can call for new priorities and new goals, so it’s important to stay flexible. A list of efficiency KPIs is not “set it and forget it.”

Learn More

- Got Goals? This Metrics Framework Gets You There. An objectives and key results — OKR — framework breaks high-level goals into concrete, achievable steps. It empowers employees, managers and teams to keep moving in the right direction and provides tools to define and measure success.

- A Comprehensive Guide to Operational Metrics & KPIs. Learn which KPIs to track and what they can tell you about the health of your operations and strategies.

- Make or Break Metrics: 20 KPIs Every Growing Business Should Track. More than just numbers, KPIs tell a story about how well a growing company is performing.

CHAPTER 6

Simpler = More Profitable

Whether it’s via the effective adoption and application of technology or through a re-examination of processes and ways of working, the endgame is to simplify or eliminate less valuable tasks employees spend time on. This leads to better use of knowledge and talent, which yields efficiency.

Your role as a finance team leader is indispensable because individual improvements aggregate to higher productivity that positively impacts profits and the organization’s financial health.

In fact, efficiency is a prerequisite for sustainable scaling. It helps your business practice good habits that will further benefit it later.

Learn More

- 17 Steps to Improve Operational Efficiency. Operational efficiency is all about how businesses reduce waste, increase productivity, and improve the quality of their products and services.

- Spectrum Color Sees New Shades of Efficiency After Centralizing Business in NetSuite. A single source of data helped this manufacturer increase revenue, automate order management and save its staff valuable time.

- NetSuite 2022 Release 2 Helps Protect Your Bottom Line By Increasing Efficiency. When faced with uncertainty, a leader’s priority is to run the businesses efficiently, focusing on robust bottom lines as much as revenue growth.

- NetSuite Automation Improves Mann Lake Bee & Ag Supply Productivity & Efficiency. Cumbersome workflows not only hindered growth at Mann Lake’s new poultry business, but also prevented expansion into other product categories and eroded employee morale.

- Mission Possible: Close Your Books in 5 Days or Less. For finance teams, speeding the monthly close and reporting process has been a priority for years — a priority that most never quite get to.

Contact Us and let’s make NetSuite easier today!