As businesses go from dozens of customers to hundreds and eventually thousands, processes that once served the company well no longer support growth. Many finance teams routinely back funding updates that let business units scale efficiently while ignoring their own department’s process improvement needs.

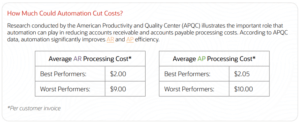

The AR/AP team, short for Accounts Receivable and Accounts Payable, is one of those groups within finance that’s often overlooked for process improvement. That’s a mistake because automation dramatically speeds both accounts receivable and accounts payable, reduces overhead, and minimizes the risk of errors. But simply looking at AR/AP automation as a cost-saving exercise will likely miss some of the biggest benefits that will come from the effort.

CHAPTER 1

Hidden Costs of Manual Processes

Say a company envisions doubling revenue over a five-year period. Without improving AR/AP, it’s reasonable to expect associated costs will also double. That alone should be reason to rethink how to get the work done. But while it’s easy to see the budgetary impact of hiring more people, manual accounting processes will likely slow the march toward doubling revenue by harming cash flow, policy compliance, customer satisfaction, financial planning and analysis, and more.

Cash Flow

Ensuring that cash flows efficiently is what AR and AP are all about. As companies grow, manual processes will slow payments and increase the likelihood that customers will see irregular handling of their accounts. Inefficiency, errors and needless expenses result from:

- Extended billing cycles. Particularly if your company sends bills on the same day of the month, manual processing takes a lot of time. The longer it takes accounts receivable to invoice a customer, the longer it will be before the business receives payment. As the company grows and business rules evolve, simply ensuring that rules have been correctly applied will add time to the process and be a source of frequent errors.

- Invoice disputes. As companies grow, so do the number of rules around customer billing. Offering different discount rates and payment terms can be a good way to drive new business, but they create a nightmare for AR teams and can negatively affect accuracy. It frustrates customers when the wrong amount appears on an invoice. Billing errors are more than a customer service issue, however, they can affect cash flow in a couple of ways. When customers are charged too much, for instance, they are likely to withhold payment until the error is fixed. This reduces short-term cash flow. Frequent billing disputes also increase customer churn, affecting long-term cash flow.

- Unnecessary expenses. Manually printing and mailing an invoice takes longer and costs more than sending the same invoice electronically. The postage, envelopes, printer ink and labor required to physically mail invoices are unnecessary expenses.

Manual AP processes, on the other hand, delay payments to vendors. This isn’t necessarily a bad thing if a company is experiencing a temporary shortfall. If payments are habitually late, however, it affects cash flow in a couple of ways:

- Higher costs. Suppliers tend to offer good customers the best prices. When customers don’t pay on time, it hurts that relationship. So a company that consistently pays late is unlikely to get the same pricing as one that always pays on time. Some suppliers also tack on late fees when bills are past due, further increasing costs.

- Missed savings. Many companies offer early payment discounts. While it may not be feasible to take advantage of every discount, an occasional early payment still saves money. But if manual AP processes make it difficult even to pay on time, then those potential savings are irrelevant.

Compliance and Risk Management

Most company founders remember the days when only they wrote checks. The minute that changed, business rules around payments began to crop up organically. Maybe CEOs only wanted to know when payments were out of line with previous recurring payments. Or, they may only want to approve expenditures over $1,000. By the time the company’s annual revenue approaches and exceeds $10 million, ad hoc rules need to be codified in precise policies. When business leaders don’t personally know all employees, authorization chains let buying happen when needed while assuring that managers and finance leads know what’s going on.

But payment policies without enforcement are merely friendly reminders that busy AP teams may be tempted to ignore. Automated systems provide enforcement, and that gives business leaders confidence that spending continues by the rules as the company grows. Automated systems will also speed the authorization process by letting managers and executives click to approve or easily ask for more details on a spending request.

Automated AP processes will also make fraud far more difficult. Approval chains are documented and logged so that no spending should happen without proper records.

Financial Planning and Analysis

Scenario planning and other finance-based analysis has become increasingly essential since 2019, when supply chains were strong and customers were doing business mostly as they’d done for years. The pandemic brought a whole new level of uncertainty for most companies, and the way to manage through was to constantly evaluate the state of the business.

One common frustration is that good data often lagged decision-making deadlines, so business leaders did the best they could with the information they had.

In our surveys of business leaders, many assessed that their companies were less data-driven in 2021 than in 2019. It’s hard to keep an analytical focus when historical data is no longer helpful and new data isn’t timely. If cash flow was an issue in 2019, it was likely critical in 2020 and beyond. Automation helps shorten the AR/AP cycle while simultaneously collecting data on the state of accounts.

When accounts become delinquent, automated AR procedures not only ensure that policies for collection are followed, they can also notify sales reps and automatically help finance understand the impacts on cash flow. These improvements in data accuracy and timeliness give planners the data they need to reliably advise decision-makers on the state of the business.

CHAPTER 2

Automation Opportunities

Accounts payable and accounts receivable staff spend much of their time performing data entry and other manual tasks. This makes AR and AP processes ripe for automation.

Accounts Receivable

By automating AR, companies can accelerate cash flow, improve invoice accuracy and reduce processing costs. Automation opportunities exist at nearly every step in the process, from invoice scheduling to collecting past-due payments.

- Billing schedules. For companies that bill customers in increments, invoices may need to be sent on a set schedule or upon completion of a specific set of tasks. Keeping track of various billing schedules and milestones for each customer is labor-intensive, especially if records are kept manually or in spreadsheets. An accounting system that gives AR staff the ability to create automated billing schedules simplifies the process and helps ensure customers are billed correctly.

- Printing and mailing paper invoices adds days to the payment process. Postal-related delays means customers receive their bills later, which can affect cash flow. Automating the billing process saves time and money. It also improves the accuracy of AR data by eliminating the need to create and post journal entries manually.

- Payment processing. Reviewing and recording hundreds or thousands of customer payments each month is time-consuming, especially if the process involves entering payment data into an accounting system manually. Processing payments this way also makes it difficult for AR staff to clear open receivables in a timely manner, leading to mismatched or overlooked payments. Automating the matching process avoids this problem by making it easier to reconcile payments with customer accounts.

- Collections. While most customers pay their bills on time, collecting from those that don’t can be challenging. An effective collections process can keep days sales outstanding (DSO) under control. Lack of automation, however, means collection efforts often consist of one-off emails and inconsistent follow up, an approach that is definitely ineffective. Automating customer communications ensures consistent follow-ups on past-due invoices, improving DSO, and reducing bad debt write offs. Automation can even improve on-time payment by alerting customers ahead of time of pending due dates.

Accounts Payable

Automating AP simplifies the payment process, helps accounting staff keep track of invoice due dates, and reduces the risk of payment fraud by ensuring vendor invoices are legitimate. Automation can also save money by ensuring on-time payment of vendor bills and making it easier for companies to identify and take advantage of early payment discounts.

- Bill payment. Printing and mailing physical checks is time-consuming, increases processing costs, and makes it more difficult to pay bills early.

Automating payment processes improves AP staff’s efficiency by eliminating these manual tasks. Automation also helps ensure timely payment of vendor bills, improving supplier relationships. Incorporating electronic payment options gives companies greater flexibility to decide how and when to make payments, allowing them to hold on to cash longer while avoiding late charges.

- Recurring invoices. Paying recurring bills, like utilities, takes just as much effort as paying any other type of invoice. However, if billing amounts are fairly consistent from one period to another, reviewing, preparing and paying each and every recurring invoice becomes tedious. Automatically posting and scheduling recurring payments eliminates this effort. An automated process that incorporates machine learning can also identify and flag unusual payment amounts, allowing AP staff to focus on addressing anomalies rather than mindlessly processing bills.

- Three-way match. It’s important to make sure goods and services have been delivered before a vendor invoice is paid. Matching the purchase order, invoice details and receiving documents is standard practice, but the process typically requires input from multiple people, including accounting, purchasing and receiving personnel. Communicating back and forth among departments to ensure an invoice is accurate can be frustrating. As a result, this three-way match doesn’t always happen. When it does, it can lead to payment delays and calls from unhappy suppliers. Automating three-way matching simplifies the process. Receiving data can be captured electronically and linked to the PO and invoice in the accounting or ERP system. This makes it easier to compare documents and approve payment.

CHAPTER 3

What to Look for in an Automated Solution

There is plenty of opportunity to increase efficiency and reduce costs by automating accounts receivable and accounts payable. There are also lots of ways to go about it. With so many options and so much technology to choose from, it can be difficult to pick a starting point. But knowing what to look for in an automation solution is the best place to begin.

- Integrated end-to-end processes. Accounts receivable and accounts payable involve different processes, and people responsible for AR shouldn’t be involved in AP (or vice-versa). The need to separate these duties could lead to the conclusion that using two different systems, one for billing and one for paying bills, is a good idea. And some organizations operate this way. This is rarely the best approach, however, as it requires at least one of these applications, and sometimes both, to be connected to the company’s accounting or ERP system. These integrations often result in sluggish performance and can be difficult to maintain. AR and AP are core accounting activities, but they cross multiple departments. To operate efficiently, they need to flow smoothly across the organization. Orders, for instance, should move seamlessly from sales to fulfillment to accounts receivable without the need for manual handoffs or duplicate data entry. This saves time during the billing process and reduces the risk of errors. Invoices go out sooner, and there are fewer billing disputes, which improves cash flow and days sales outstanding. Poorly integrated systems interrupt these processes, which can lead to delays, errors, late payments and customer billing disputes. Managing order-to-cash and procure-to-pay cycles within a single, automated system helps avoid these issues.

- Centralized data. Accounting personnel often need information from people outside their departments to do their jobs. To invoice customers, for example, AR staff need to know when orders ship or what services have been delivered. In the latter instance, this could include how many hours to bill at what rates, pass-through costs and whether specific milestones have been completed. AP staff need invoices approved and the ability to compare them to purchasing and receiving data. Using different systems for billing, payment processing, banking and accounting can make it difficult for team members to access the information they need when they need it. Even if these disparate systems are integrated using custom code or third-party connectors, batch processing prevents data from being available in real time. Multiple systems also mean multiple user interfaces with different user IDs and login credentials. Switching between systems is inefficient. And lack of real-time data can lead to payment or billing errors.

- Cloud platform. Cloud-based systems are accessible anytime from anywhere an internet connection is available. With more companies allowing employees to work remotely, and a changing workforce that prefers this option, accessibility is critically important. Requiring accounting staff to spend most or all of their time in an office environment is becoming an obstacle to recruiting and retaining experienced people. Cloud accounting software makes it easy for team members to collaborate while also allowing them to complete any assigned task without being in the office. Cloud-based systems also reduce IT workloads, eliminate the need for costly dedicated hardware, and avoid the security headaches that come with on-premises systems.

CHAPTER 4

Automating AR and AP With NetSuite

NetSuite delivers a complete accounting system perfect for companies ready to move from entry-level accounting software and spreadsheets to a fully connected and automated solution. NetSuite eliminates manual data entry, minimizes the resources needed to manage AR and AP and in the process ensures accuracy and compliance while freeing resources for more strategic work.

NetSuite automates AR and AP processes by collecting all information from across an organization in a central database and using the data repository to automate workflows.

NetSuite not only provides the platform for process automation, it helps the business establish and maintain rules that ensure compliance with legal and regulatory mandates. The accounting features built into NetSuite, for example, help companies establish strong financial controls and ensure adherence to applicable regulatory and accounting standards.

Automating AR and AP with NetSuite saves valuable time and increases the efficiency of accounting staff by eliminating labor-intensive tasks. These are just some of the capabilities NetSuite provides:

- Automates the creation and scheduling of invoices and increases collections by sending payment reminders automatically.

- Makes it easier for customers to make payments by including a “pay now” option on electronic invoices.

- Simplifies accounts payable with automated invoice scanning and general-ledger code assignment, three-way invoice matching, and automated outbound payments.

- Automatically posts order transactions to the general ledger, with accurate tax calculations on each invoice, for rapid, precise tax processing and billing.

Learn More

- 17 Steps to Improve Operational Efficiency. Operational efficiency is all about how businesses reduce waste, increase productivity, and improve the quality of their products and services.

- Spectrum Color Sees New Shades of Efficiency After Centralizing Business in NetSuite. A single source of data helped this manufacturer increase revenue, automate order management and save its staff valuable time.

- NetSuite 2022 Release 2 Helps Protect Your Bottom Line By Increasing Efficiency. When faced with uncertainty, a leader’s priority is to run the businesses efficiently, focusing on robust bottom lines as much as revenue growth.

- NetSuite Automation Improves Mann Lake Bee & Ag Supply Productivity & Efficiency. Cumbersome workflows not only hindered growth at Mann Lake’s new poultry business, but also prevented expansion into other product categories and eroded employee morale.

- Mission Possible: Close Your Books in 5 Days or Less. For finance teams, speeding the monthly close and reporting process has been a priority for years — a priority that most never quite get to.

Contact Us and let’s make NetSuite easier today!